30+ Fixed rate mortgage calculator

With a 15-year fixed-rate loan you are likely to have to pay a higher monthly mortgage payment but you will pay far less interest over the life of the loan. Rates on a 30-year fixed rate mortgage FRM ran between 395 on the low end and 534 on the high.

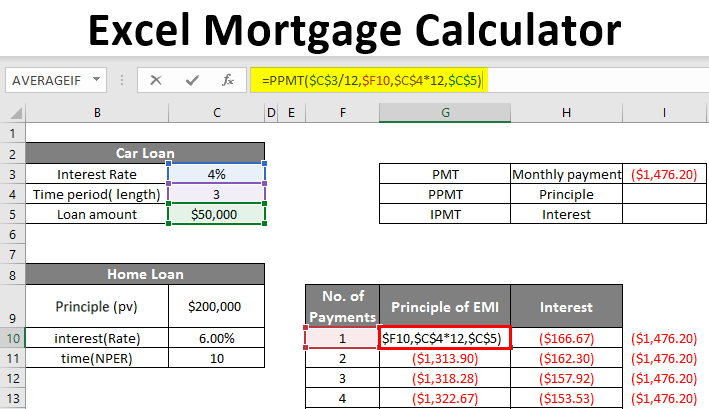

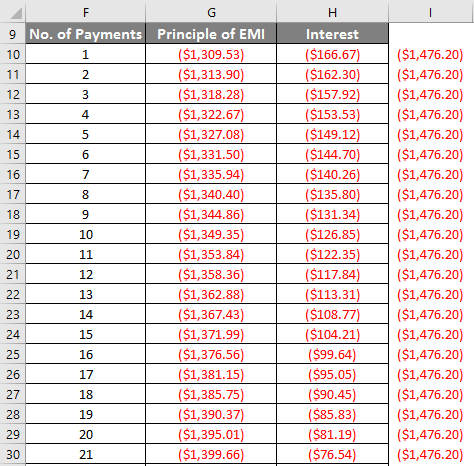

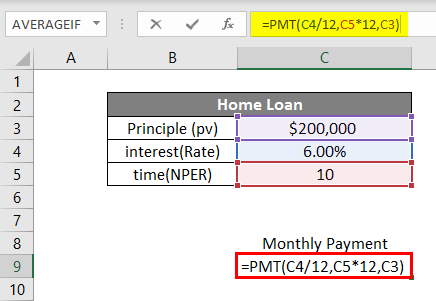

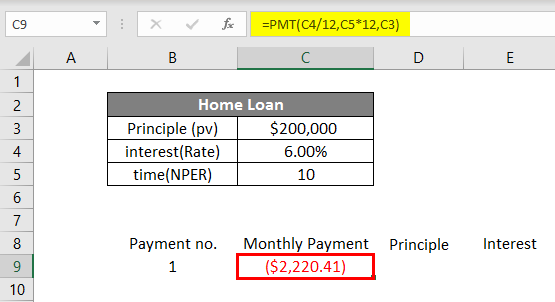

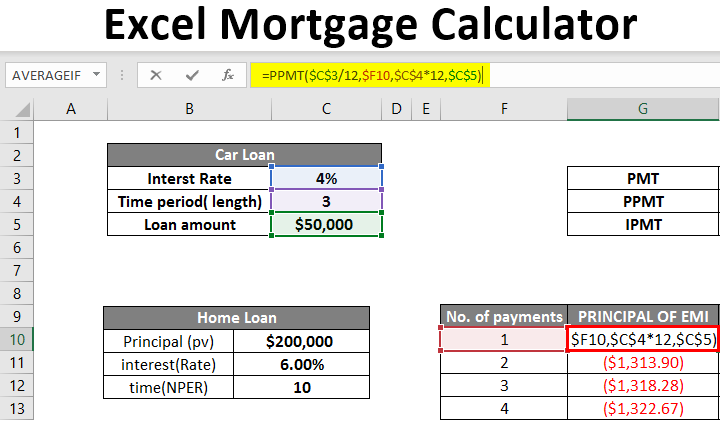

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Use this free New York Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest.

. When mortgage rates are at a low interest period a fixed-rate mortgage may make the most sense. Choose from 30-year fixed 15-year fixed and 5-year ARM loan scenarios in the calculator to see examples of how different loan. The fixed-rate portion of the HELOC can be locked in for terms ranging from five to 30 years during which time the loan is paid back like a typical mortgage says Vikram Gupta executive vice.

As a result payment amounts and the duration of the loan are fixed and the person who is responsible for paying back the loan benefits from a consistent single payment and the ability. Is it possible to have fixed home loan interest rates last 20 years or 30 years. Use a mortgage payment calculator.

Use our simple mortgage calculator to quickly estimate monthly payments for your new home. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily Freddie Mac etc. Freddie Mac reported an average mortgage rate for 30-year FRM of 309.

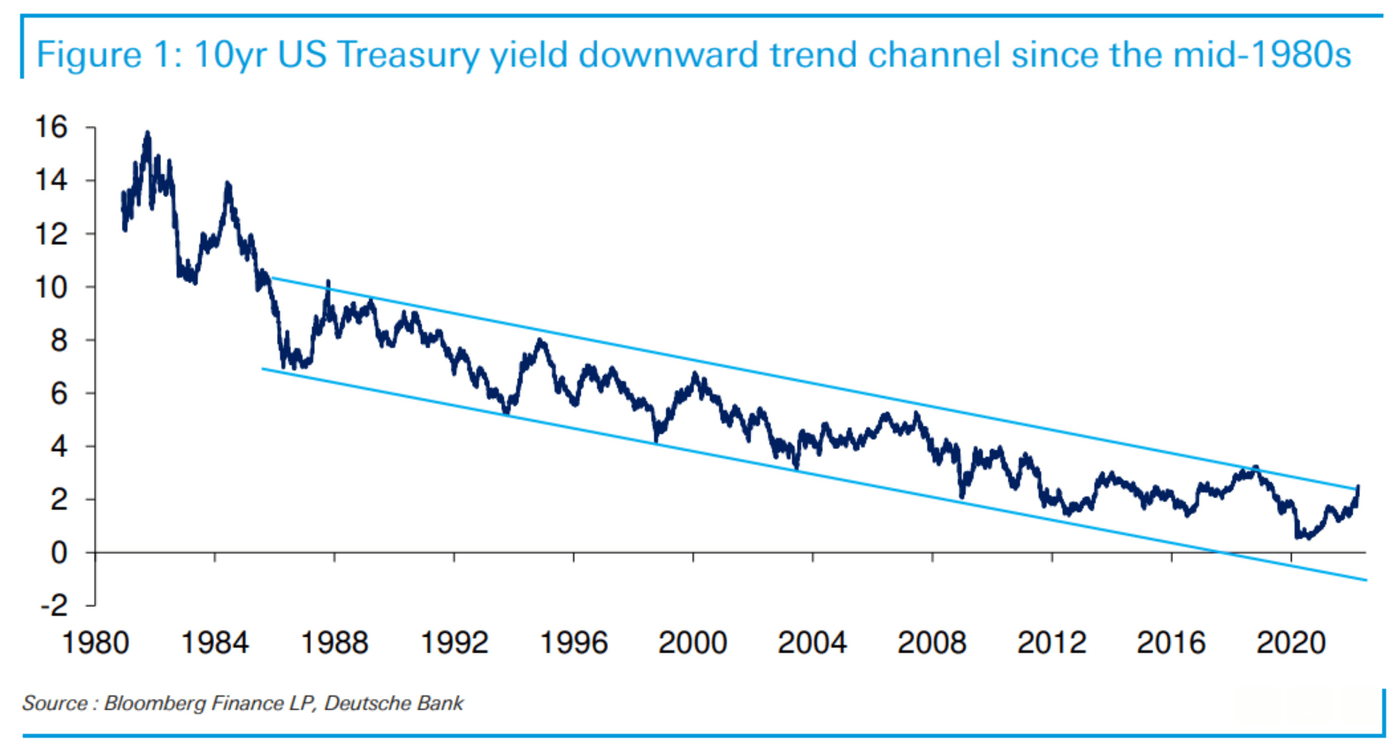

With a fixed-rate mortgage your monthly payment stays the same for the entire loan term. By default 250000 30-yr fixed-rate loans are displayed in the table below. Mortgage rate forecasts predict a continued increase by years end which some attribute to inflation driven by temporary supply-chain issues.

Use this fixed-rate mortgage calculator to get an estimate. Todays national mortgage rate trends. Todays national 30-year mortgage rate trends On Wednesday September 07 2022 the current average rate for a 30-year fixed mortgage is 602 increasing 8 basis points compared to this time last.

30 Year Fixed 6250. At the end of the 30 year repayment period the loan is fully amortized. Find out about the longest fixed rate mortgages available in Australia.

By default 30-yr fixed-rate loans are displayed in the table below. Or call us. If you take out a 30-year fixed rate mortgage this.

The 30 year fixed mortgage is a simple loan program that is one of the most popular choices for homebuyers today. If you prefer predictable steady monthly payments a 30-year fixed. Find average mortgage rates for the 30 year fha fixed mortgage from Mortgage News Daily and the Mortgage Bankers Associations rate surveys.

Our calculator defaults to the current average rate but you can adjust the percentage. For example a 30-year fixed. Remember your actual mortgage rate is based on a number of factors including your credit score and debt-to-income ratio.

We offer a wide range of loan options beyond the scope of this calculator which is designed to provide results for the. This free mortgage tool includes principal and interest plus estimated taxes insurance PMI and current mortgage rates. Find information and rates for 15 20 and 30-year fixed-rate mortgages from Bank of America.

Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3. Filters enable you to change the loan amount duration or loan type. Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages.

Fixed-rate loans are typically available for 10- 15- 20- or 30-year loan terms but other terms may be available. What is a 30 year fixed rate mortgage. Your monthly payment stays the same for the entire loan term.

The average interest rate for the most popular 30-year fixed mortgage is 548 according to data from SP Global. With a fixed-rate loan the interest rate remains the same for the entire span of the mortgage. On Wednesday September 07 2022 the current average 30-year fixed-mortgage rate is 602 increasing 8 basis points over the last week.

The interest rate of your mortgage. Refinance to a fixed-rate mortgage. Filters enable you to change the loan amount duration or loan type.

How much money could you save. 15 Year Fixed 5000. 20 to 30 Year Fixed Rate.

Find out how to best use a fixed rate to your advantage. Compare lenders serving Redmond to find the best loan to fit your needs lock in low rates today. When talking about a 30-year fixed-rate mortgage it typically refers to conventional loans.

Safis says the average rate difference between a 106 ARM and a 30-year fixed mortgage can be about 05 to 075. Put in any amount that you want from 10 to 1000 to find out what you. A fixed-rate loan offers a consistent rate and monthly mortgage payment over the life of the loan.

This home loan has relatively low monthly payments that stay the same over the 30-year period compared to higher payments on shorter term loans like a 15-year fixed-rate mortgage. This fixed-rate mortgage calculator provides customized information. 3 Year Fixed Rate.

That means youll know exactly what to expect including. 20 Year Fixed 5750. The portion of your payment that goes toward principal and interest.

A fixed-rate mortgage FRM is a mortgage loan where the interest rate on the note remains the same through the term of the loan as opposed to loans where the interest rate may adjust or float. The primary advantage of a 30-year fixed-rate loan is that you can lower your payments to a more manageable level without having to take on a risky loan such as. The amount of your regular mortgage payments.

30 Year Fixed. Use the above mortgage over-payment calculator to determine your potential savings by making extra payments toward your mortgage. A fixed rate mortgage offers a specific interest rate that is fixed or locked-in for the term of the mortgage.

A 30-year fixed-rate home loan is a mortgage that will be completely paid off in 30 years if all the payments are made as scheduled. The first two options as their name indicates are fixed-rate loans. We offer a wide range of loan options beyond the scope of this calculator which is designed to provide results for the most popular loan scenarios.

However when interest rates are rising its a different market. In the drop down area you have the option of selecting a 30-year fixed-rate mortgage 15-year fixed-rate mortgage or 51 ARM. This fixed rate mortgage is a home loan with an interest rate that remains the same throughout the 30 year term.

The majority of fixed rate home loans are locked in for a term of 3 to 5 years. Lock-in Redmonds Low 30-Year Mortgage Rates Today. A 30-year fixed-rate mortgage is by far the most popular home loan type and for good reason.

Finally in the Interest rate box enter the rate you expect to pay. Mortgage interest rates are always changing and there are a lot of factors that.

Best 10 Mortgage Calculator Apps Last Updated September 8 2022

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Simple Mortgage And Loan Calculator With Amortization Schedule R Internetisbeautiful

Airbnb Stay Tracker And Management Expense Cleaning Fee Etsy Rental Income Being A Landlord Rental Property Management

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Fv Function In Excel To Calculate Future Value

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Airbnb Rental Income Statement Tracker Monthly Annual Etsy Airbnb Rentals Rental Income Rental Property Management

![]()

Best 10 Mortgage Calculator Apps Last Updated September 8 2022

Mortgage Calculator Stacy Jetton Sr Mortgage Broker

265 One Month Money Challenge A Fun Way To Save Earn Nearly 300 Without Even Trying Money Saving Challenge Savings Challenge Money Challenge

Average 401 K Account Balance By Age Vs Recommended Balances For A Comfortable R Retirement Planning Finance Average Retirement Savings Saving For Retirement

Mortgage Calculators Lowermybills Mortgage Refinance Mortgage Mortgage Help

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

7 Ways To Make An Extra 500 1000 Per Month Updated For 2022 Money Saving Challenge Savings Challenge Money Challenge

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Pin By Michelle Sherman On Financial In 2022 Money Management Advice Saving Money Budget Financial Life Hacks